The Feud Between Binance and FTX is Heating Up

Crypto Utopia or troubles in Paradise of Web 3.

Hey Guys,

It’s highly probable that Binance and FTX become the default duopoly in the purchasing of crypto. But something must be said about the current fiasco.

For the love of FOMO, less supply and more demand means Bitcoin’s price just keeps going up like a ponzi scheme. Powerful founders and companies own huge shares of the market of all the greed, envy of fear of missing out.

Sometimes they dragon-dance.

Binance to liquidate its entire FTX Token holdings after ‘recent revelations’

Binance CEO Changpeng Zhao cited “recent revelations” as the reason for the liquidation, noting the sale of its tokens could take months to complete due to the size of its position.

The Founders of Binance and FTX are incredibly wealth and seemingly in competitive mode now.

These crypto overlords have huge followings on Twitter and clearly FTX was playing dirty with Binance. CZ was in no mood to support the treachery.

Binance CEO Changpeng “CZ” Zhao tweeted that his exchange would slowly withdraw billions of its holdings in FTX’s native token, FTT, “due to recent revelations that have came to light.” The cryptic concerns of crypto Billionaires you know, where Bitcoin is the sun and we are the descendants of the new world.

The head of FTX sister company Alameda Research offered to buy as much FTT as Binance wants to sell. Okay, a bit confusing.

In revenge for FTX “going behind the back” of Binance in loybbing moves Binance wrote this about FTX:

In a later tweet, CZ explained the FTT liquidation was “just post-exit risk management,” referring to lessons learned from the fall of Terra’s Luna Classic (LUNC) and how it impacted market players. As if to insinuate that FTX was in an insolvency risk state, usually reserved for Coinbase rumors.

Got that?

Meanwhile crypto traders are scurrying to hedge against a potential slide in crypto exchange FTX's native token, FTT, in the wake of Binance's decision to liquidate FTT holdings and controversy surrounding Alameda's balance sheet.

FTT is down 22% in the last 24 hours.

Crypto is a pretty sick Kingdom though:

SBF (tycoon #2) also had a reply:

Concerns surrounding FTX’s liquidity grew following a Thursday report from CoinDesk about the balance sheet of Alameda Research, a crypto trading firm once run by FTX CEO Sam Bankman-Fried. Alameda holds $14.6 billion in assets with $8 billion in liabilities as of June 30, CoinDesk reported.

Trouble in paradise? Not so Utopia where even the duopoly winners are fighting like kids. What a brave new world Web 3 must be!

Powerful interests facing off indeed:

Meanwhile the crypto winter grinds us in a hush of any real enthusiasm while Bitcoin vultures circle like token cannibals around Bitcoin’s price hovering continuously around $20,000 USD.

Bitcoin was originally worth next to nothing. The transaction that first gave Bitcoin monetary value was in October 2009, when Finnish computer science student Martti Malmi, known online as Sirius, sold 5,050 coins for $5.02, giving each Bitcoin a value of $0.0009 each.

The token is not tied to any real world asset and its value it based purely on speculative demand for distributed ledger technologies that were supposed to “change the world”. So many dead blockchains and dead projects and extinct tokens, one has to wonder what is going on?

Let us pray then at the Bitcoin altar to gather our thoughts and enter crypto congress. Demi-gods SBF and CZ, please don’t fight. It doesn’t make us look good in the MSM.

Angelic CZ it seems had had to take a stance: He also added “we won’t support people who lobby against other industry players behind their backs.” SBF is more a wheeling and dealing founder, clever sort of mafia indulgent.

We have exalted overlords in a Metaverse of crypto, a layer of the internet with so much support from young Millennials and GenZ, it’s almost like a cult-movement or a doomsday cult of profit. Profit that thing already so exalted in America to the detriment of everything else, even more central - even exalting tokens with no real point. Headless assets with no correlation to anything in the “real tangible world”.

There we let Princes of crypto fight it out to be Emperor. Alameda Research CEO Caroline Ellison (Stanford), in a Nov. 6 tweet, however, said the balance sheet wasn’t reflective of the true story, noting that the sheet in question is only for “a subset of our corporate entities” and other assets worth over $10 billion “aren’t reflected there.” Thanks for clearing that up for us Caro!

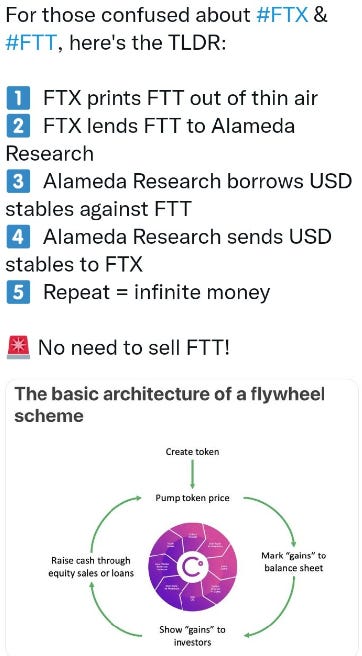

A Crypto of Infinite Money

Ah this certainly doesn’t pose any risk for crypto investors and FTT buyers right? Right?

$FTT was as high as $26 at the beginning of November, 2022. How low do you suppose it goes? $15 would be my guess.

Sam Bankman-Fried’s crypto exchange FTX experienced an increase in withdrawals after competitor Binance Holdings Ltd. announced plans to divest its entire holding of FTX’s native FTT token. But hey, let’s all just be friends.

“Based on the on-chain flows, it looks like FTX is experiencing a high volume of withdrawals,” said Hayden Hughes, chief executive of Singapore-based trading platform Alpha Impact. “So far it looks that they’ve been able to meet those.”

Reserves of stablecoins on FTX dropped to $114 million on Monday from $394 million three days earlier, according to data from CryptoQuant.

Binance to Sell $529 Million of Bankman-Fried’s FTT Tokens. I mean that’s a lot considering the peculiar way FTX and FTT seem to be connected.

If FTX grew 1000% during the crypto crazy of the 2020 stock boom, why hasn’t it corrected more in the crypto winter instead of buying people out? Meanwhile the The House Committee on Oversight and Reform is dialing up the pressure on federal agencies and crypto exchanges to protect Americans from fraudsters.

Watching crypto feuds on Twitter while Musk is dismantling it from the inside, how very “decentralized”.

Let’s all pray that our money will be alright. Choosing the right crypto Tyrant might be key.