Hey Guys,

Just a little not on some breaking news.

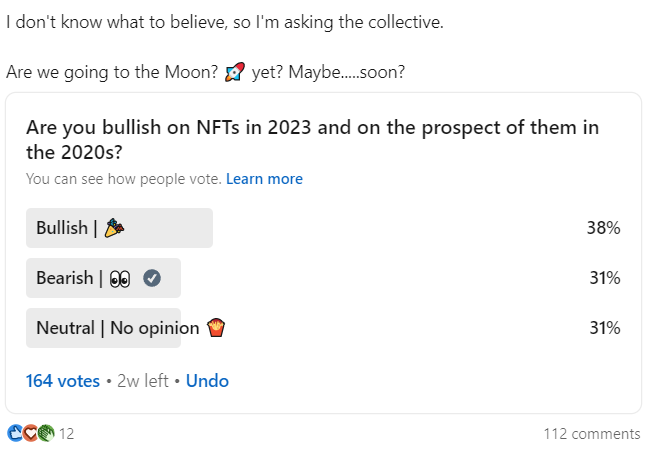

I recently tried to survey some NFT professionals around me on LinkedIn about how they say the future of NFTs going. You can see and vote on the poll here.

It turns out my timing was a bit spot on, as even Solana has been down for the past 7 hours due to NFT spill over.

Largest NFT mint in History

Yuga Labs, the web3 company behind the Bored Ape Yacht Club, disrupted the entire Ethereum blockchain as a flood of users rushed to purchase NFTs representing virtual plots of land in its upcoming metaverse project, Otherside. This weekend.

A total of 55,000 Otherdeeds sold at a flat price of 305 ApeCoin, or around $5,800 at the time of purchase (via CoinTelegraph), raising about $320 million in what was considered the “largest NFT mint in history.”

Yuga Lands is hacking the internet and breaking Ethereum and Solana while they are at it.

The Bored Ape Yacht Club crashed Ethereum on Saturday night. As part of the upcoming Bored Ape metaverse called Otherside, developers Yuga Labs on Saturday launched a new NFT collection which consists of 100,000 land deeds for the virtual world.

It’s truly quite bizarre and shows you the extent of the FOMO. Yuga Labs is yet another a16z backed NFT heist.

Their absurd seed round funding recently pegged them to have a market cap of $4 Billion. How? Some Venture Capitalists must have a lot of money behind creating and keeping up the hype for NFT platforms.

Yuga Labs, maker of the multimillion dollar monkey JPEGs that plenty of NFT skeptics love to hate, just raised a $450 million round from Andreessen Horowitz at a $4 billion valuation in late March, 2022.

Ethereum as it turns out is still pretty broken when it comes to scalability. Otherdeeds are minted in BAYC’s native ApeCoin, but still require Ethereum for gas fees. A gas fee is the cost associated with a transaction on the Ethereum blockchain. Fees typically increase as the network gets more congested, as it becomes more work to process a transaction.

A Microsoft director Raphael Brown recently posted on LinkedIn:

The decentralization movement continues to look both increasingly centralized in its philosophy and heavily inefficient in its technology. High gas (transaction) fees, failed transactions, struggling network traffic, paying more in fees than the transaction cost. Now they're talking about building their own walled garden. This is still an investor space and not a consumer space.

Keep in mind the total users involved were not high. 55k users. Traffic from 55k users brought parts of ethereum to a standstill as speculative retail investor, not gamers, not players, shelled out thousands to tens of thousands apiece all in the hopes that other people will leave social media, and gamers will leave games, and they will all magically come to this unbuilt web world to rent from the 55k early adopters all who hope to grow their investment. How is this sustainable?

I sort of see his point. Microsoft with their acquired Gaming Empire must be seeing this NFT hype as potentially a threat as the future of the Gaming Metaverse and Web3 collides.

Not cool crypto bros

Such a large volume of transactions during the Otherdeed mint caused gas fees to soar. As noted by CoinTelegraph, Reddit user u/johnfintech pointed out that some buyers shelled out anywhere from 2.6 ETH ($6,500) to 5 ETH ($14,000) in gas fees alone — more than the cost of an Otherdeed NFT (and in some cases, more than twice the cost).

How is this a sustainable trend?

The Hype of Otherside

Otherside is Yuga Labs' take on the metaverse. It'll be a virtual world made up of 200,000 plots of land, which will be purchased, owned and traded as NFTs. Land being sold as NFTs is a confusing concept, but traders are hoping land in heavily frequented metaverses will prove ultra valuable; imagine owning a building in the center of a game like Fortnite and being able to do what you like with it.

Meanwhile every manner of digital twin, Metaverse, gaming ecosystem and DeFi startup is trying to hitch a ride with the NFT hype.

Yuga Labs is yet another a16z backed NFT platform to hit the jackpot of FOMO. OpenSea and Coinbase both also are major NFT gateways. Chris Dixon, one of the key evangelists and VCs of Web3 must be laughing his way to the bank.

Yuga Labs issued an apology on Twitter shortly after the mint ended. “We’re sorry for turning off the lights on Ethereum for a while,” Yuga Labs said. “It seems abundantly clear that ApeCoin will need to migrate to its own chain in order to properly scale.

We’d like to encourage the DAO [decentralized autonomous organization] to start thinking in this direction.” The ApeCoin DAO, the entity responsible for making decisions within the ApeCoin community, exists separately from Yuga Labs. The DAO’s decisions are carried out by the Ape Foundation’s Board, consisting of Reddit co-founder Alexis Ohanian, Animoca co-founder Yat Siu, and others.

Maybe Substack who share the same backers should allow writers to have NFT integration to help us monetize. Support an artist or Creator crypt bros!

As outlined in a post days before the mint, Yuga Lab’s original goal was to avoid an “apocalyptic” gas war, or a sudden spike in gas fees due to high demand. But when you feed the FOMO of the peasants with too much VC oil, it gets a bit hot on the blockchain that is barely scalable yet. The Metaverse frenzy is embarrassing for many reasons. That so much of the hype is VC money generated is pretty transparent, and getting every more centralized.

Yuga Lab's ApeCoin hit record highs just days before the "Otherside" metaverse opens its doors for sale on Saturday April 30th, 2022 at 9:00 PM ET. What resulted isn’t exactly surprising but shows you how immature the space truly is thus far.

We all seem quite willing to go through crypto hoops to get what they tell us we should have.

To get in on this much-anticipated metaverse and mint Otherside NFTs requires purchasing ApeCoin ($APE), the governance and utility token for the entire Ape ecosystem, and the legal tender in this new, exclusive metaverse.

While crypto markets have been in the red over the past week, the price of $APE has been going green in anticipation of BAYC's metaverse ((as the saying goes, the grass is always greener on the otherside (I saw what you did there!)).

It said it would ditch the popular Dutch auction style of minting, in which an NFT goes up for sale at a certain ceiling price and is then incrementally lowered over time. It employed an alternate method instead, selling NFTs at a flat price and opting to gradually allow more mints to occur over time.

The Road to Otherside

In March, Yuga Labs raised $450 million in funding to build the Otherside, a decentralized metaverse with elements of gamification.

While it’s supposed to encompass Yuga Lab’s NFT brands, such as the newly-acquired CryptoPunks and Meebits, the company has goals to extend support to NFTs from other entities. A lot is still unknown about the prospective Otherside, but that clearly hasn’t stopped its enthusiastic community from investing in the project.

Otherside is the biggest product launch yet from the company best known for creating the Bored Ape Yacht Club NFT (non-fungible token) collection. During last night's sale, traders snapped up a limited supply of 55,000 “Otherdeeds” NFTs, which represent titles to plots of virtual land in a forthcoming 3D social space.

This means BAYC team raised about $285M with otherside NFTs.

While the resulting land rush generated roughly $285 million for the company, it also created some of the highest gas fees in the history of the Ethereum network that is making us question the current system at large.

They cost about $7000 each, and were only available for purchase in ApeCoin (APE), Yuga Labs’ official cryptocurrency. On secondary marketplaces like OpenSea, the cheapest listed price for an Otherdeed was around 7 ETH (roughly $19,000). All of this is getting quite expensive for investors and lucrative for the NFT landlords and not so decentralized companies.

What do you make of it all?

If you value my work consider supporting me, I cannot continue to write without community support.

Edit:

The Final 24-hour Tally

💎🔮 Those are some big numbers from Yuga Labs and The Otherside.

55,000 NFTs were minted at 305 APE each, which means each "Otherdeed" cost about $5,800 given Apecoin’s price at time of mint.

Yuga Labs raked in over $318.7 million from this mint alone.

Otherdeed already has seen over $242 million in total secondary volume traded.

Of that figure, over $190 million was on OpenSea.

In all, that’s $561 million.