Can Terra Sustain its Growth?

The best report to quickly understand Terra's ecosystem

Hey Guys,

I wanted to do a quick dive on Terra. Terra $LUNA remains the 8th biggest cryptocurrency according to coinmarketcap.com.

It only took Terra one year and 22 protocols to become the second-largest DeFi blockchain. A new report outlines its prospects, and it caught my attention. I wanted to outline some of its finding and potential growth trajectory.

Here we outline its evolution as a DeFi giant on the rise. Terra is a proof-of-stake blockchain ecosystem that aims to introduce cryptocurrencies as a means of payment to a broad audience. The team has successfully integrated the dual token model, where the minting and burning of the LUNA token control the supply and price of Terra’s stablecoins, including Terra USD (UST), TerraGBP, TerraKRW, TerraEUR and the International Monetary Fund’s TerraSDR.

The mechanism that keeps Terra's algorithmic stablecoin UST stable is rather interesting. Unlike other centralized stable coins, UST isn't backed by U.S. dollars, but is fixed to the U.S. dollar via a minting and burning process for LUNA.

If the price of UST falls off its peg and goes lower than $1 per token, UST can be swapped for LUNA (which is minted) and sold for $1, providing arbitrage gains for investors. The inverse is true on the upside, where higher demand for UST means more LUNA is burned, reducing LUNA's supply and increasing its price.

Say What?

Moreover, the fluctuations in mining rewards are minimized through transaction fees and LUNA’s burn rate variations. Notably, the rewards are programmed to increase as the blockchain’s ecosystem grows.

Simultaneously, multiple developers are working on innovative decentralized applications (DApp) on top of the Terra blockchain, including Mars Protocol, Anchor and Chai. Numerous companies, such as Kado, have established the payment infrastructure. There are some nonfungible token (NFT) market participants, too, where Levana, Talis and Knowhere are aiming to create a thriving ecosystem. Simultaneously, TFM, a DeFi and NFT aggregator on Terra, aims to unite the whole Terra ecosystem and become the ultimate go-to place for newcomers.

However if Bitcoin is now more tethered to BigTech and those stocks are in trouble in 2022, $LUNA’s crazy price ascent and volatility may be too good to be true.

What would happen if UST, the most abundant Terra stablecoin, was subject to the United States Securities and Exchange Commission’s regulatory measures? That seems rather likely at this point. We know stablecoin regulation is coming.

Terra’s Crazy 2021

At the beginning of 2021, Terra Luna was a poorly known blockchain with only $300 million in market capitalization. Since then, Do Kwon and Daniel Shin, co-founders of Terra, have managed to increase this number to $39 billion (as of April 4, 2022). As DeFi becomes more mainstream, Terra $LUNA seems well positioned.

In the race for market share in the stablecoin space, Terra is surging higher as investors seem to believe this algorithmic stability mechanism is feasible over the long term. The introduction of this Bitcoin reserve provides for an increased margin of safety for investors. Still we can expect more volatility ahead as the 2021/2022 surge may not be quite sustainable.

By investing in LUNA, you are part of the growth of the Terra ecosystem. As more demand for UST is created, LUNA is automatically burned, making the remaining tokens more valuable (almost like a share buyback in the traditional stock market). The growth of the Terra ecosystem is exploding for a variety of reasons.

An Ethereum Killer?

Initially founded by Do Kwon (Stanford) and Daniel Shin (Wharton School), Terra is a proof-of-stake blockchain that aims to incorporate cryptocurrencies as a means of payment throughout a broad audience.

The rapid adoption of Terra’s DApps, successful realization of the underlying blockchain technology, tokenomics and elevated interest from market infuencers resulted in Terra’s success amongst the blockchains targeting DeFi and making Terra one of the “Ethereum killers.”

I believe Terra’s tokenomics was just superior in some sense. The Terra protocol supports the algorithmic model, utilizing a dual-token system to maintain its stablecoin peg: Terra stablecoins and LUNA. Terra has a family of stablecoins pegged to a suite of fat currencies, including the U.S. dollar, euro, British pound, Korean won, Japanese yen and others.

To give you an idea of kind of growth we have seen here: there are nearly 3.5 million unique Terra wallet addresses, compared to about 900,000 at the beginning of 2020. That works out to 400% user growth in two years. That’s always a good sign and demonstrates how Terra is still just in its beginning phase of growth.

Growth Prospects Appear Strong

According to the CoinTelegraph report with multiple experts, the demand for stablecoins has been steadily accelerating over the last years, so UST, the pivotal coin of the Terra ecosystem, will follow the trend as Terra continues to actively grow and support its developers with such initiatives as Terraform Capital fund.

As more protocols launch on Terra after Columbus-5, the rate of UST’s supply growth will accelerate, thereby causing a reduction of LUNA’s supply.

Anchor Protocol ofers the opportunity of stable, low volatility yields on Terra’s stablecoins and is an integral part of the Terra ecosystem. Since its launch in April 2021, its total value locked increased tenfold, reaching a staggering value of $15.9 billion (as of April 4, 2022).

Terra’s Partner Ecosystem Shows Diversification

Having processed more than 12 million transactions, CHAI is a significant player in the mobile payments market in South Korea. Partnerships with multiple local banks and a convenient user interface, in many ways similar to PayPal, have allowed Terra to become one of the first blockchains that can be used for everyday real-life payments.

Growing adoption of Anchor and other Terrabased DeFi protocols has boosted the market capitalization of LUNA, which skyrocketed from $300 million at the beginning of 2021 to over $30 billion by the end of that same year. Cardano and Solana, although still enjoying higher market capitalizations, are losing ground to LUNA.

The introduction of CosmWasm’s collaboration with Terra opens new broad horizons for the development possibilities of the platform. CosmWasm is a secure, stable and interoperable platform that allows the creation of multichain contracts.

Terra enhances the liquidity of its assets by activating the Cosmos Inter-Blockchain Communication (IBC), which now connects 25 blockchains in total. Joining IBC allows over 250 decentralized applications to be potentially added to Terra in the future. Terra is also connected to Solana, BNB Chain and Ethereum through various bridges.

Investors and Backers

Since Terra’s launch, the blockchain has received a $32 million in investments from the most prominent cryptocurrency exchanges and major crypto venture capitalists, including Polychain Capital, Arrington XRP and others. Terra is also supported by Terra Alliance, a conglomerate of international companies whose total transactions in 2020 totaled $49 billion.2 This has signifcantly accelerated Terra’s ecosystem development and real-world adoption.

NFT Hype Accelerated Terra $LUNA adoption in 2021

As the crypto community actively entered the Terra ecosystem, NFTs also played a role in this. Multiple nonfungible token (NFT) projects and DeFi applications were developed using CosmWasm, a Cosmos-based smart contract platform and Terra’s Java and Python SDKs. In turn, these community-developed projects, including Mars, TFM, Astroport and Levana, have increased the interest in Terra even more.

Cross-Chain Ops and Columbus-5 Update

The recent Columbus-5 update has benefited the blockchain in multiple ways, including enhancing cross-chain operability and increasing Terra’s sustainability.

Nevertheless, regulatory authorities may detrimentally impact Terra’s market position in the future.

The rapid adoption of Terra’s DApps, successful realization of the underlying blockchain technology and tokenomics, as well as elevated interest from market influencers resulted in Terra’s success among blockchains targeting DeFi in 2021 and branding Terra as an “Ethereum killer.” This can be seen from the blockchain’s market capitalization and LUNA’s 24-hour volume growth over the last year.

Terra Money

There are three main stablecoin types: fat-backed, crypto-backed and algorithmic.

Terra Money is a set of decentralized stablecoins whose value is regulated by the algorithmic model involving LUNA’s seigniorage.

Delegators benefit from staking LUNA in two ways: the LUNA burning mechanism and the rewards earned from transaction fees.

Top Stablecoins in 2022

NFT Growth Momentum

Luart is the fastest growing NFT Marketplace and Launchpad in the Terra Ecosystem. Luart brings a gamified experience to NFTs, allowing users to be rewarded for just being a user.

Luart launched December 2021, raising $5 million in a private round, and has minted 40,441 NFTs. That’s pretty impressive adoption so far for missing much of the 2021 NFT hype train.

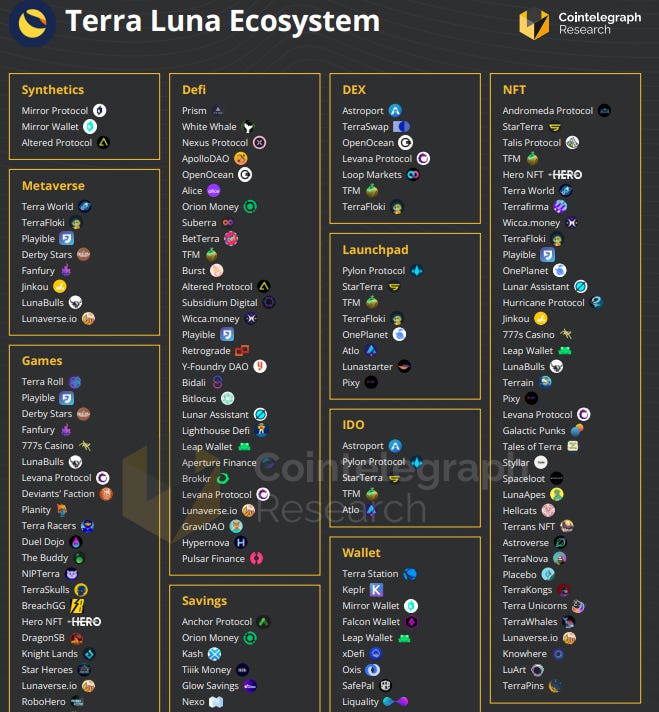

Scope of Terra’s Ecosystem

One of the things that’s most impressive about Terra is its ecosystem.

It’s too long for a single image.

Indeed it’s getting longer in 2022 as well.

It also shows you how DeFi is implicated in the future of NFTs and Dapp gaming. Anyways I hope you enjoy my visit through the halls of Terra care of Cointelegraph’s report.