Bitcoin worth $1.5B withdrawn from Coinbase in 48 hours

Confidence in Centralized Exchanges appears Shaken

Hey Guys,

Let’s talk about COIN 0.00%↑

Sometimes the headlines really tell the story. With low confidence in the future of Genesis, exchanges like Coinbase and Kraken are seeing very limited services amid market turbulence.

It’s nearly peak crypto winter.

$BTC Bitcoin is still hovering around $16,000, but likely not for long. It’s lost 65% of its value so far in 2022.

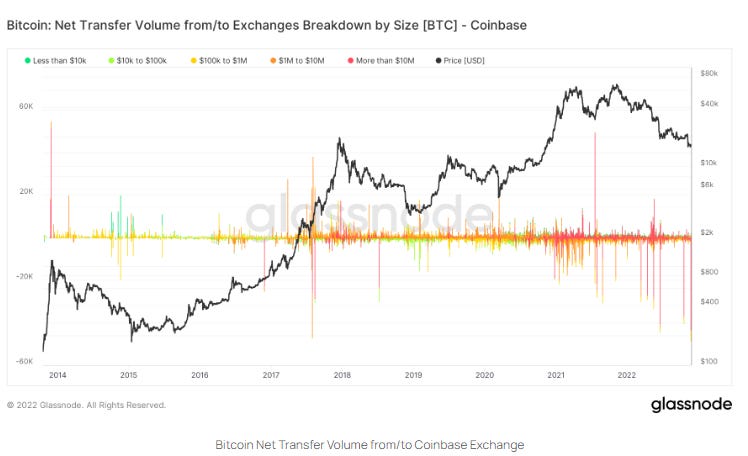

50,000 Bitcoin were withdrawn from Coinbase on Nov. 24 and 25, marking the third-largest withdrawal from the exchange. This is an incredible amount of funds as speculation on the future of Coinbase mounts. I covered this recently in my investing Newsletter.

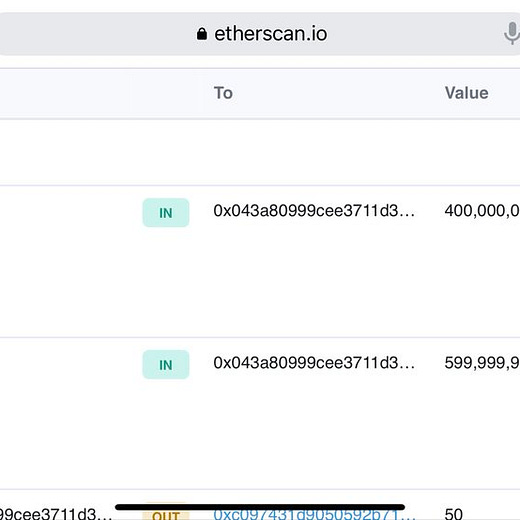

I think what we are seeing is Bitcoin whales putting their Bitcoin in safer places. A total of 100,000 Bitcoin (BTC) were withdrawn from Coinbase in the past two days, marking the third-largest BTC withdrawal in Coinbase’s history.

Just what crypto contagion will do to Genesis and others like Coinbase is a matter of speculation but is on-going and worsening, according to reports. Bitcoin fell to a week-and-a-half low on Monday and other major cryptocurrencies fell sharply, as the impact from the dramatic collapse of FTX continues to ripple through the market.

Crypto Crisis Shrinks ETF Assets in Market That Embraced Them

Everything points to the crypto winter getting worse in 2023, as recession, inflation and crypto startups running out of money all come to head.

El Salvador’s presidency dispatched a digital-securities bill to lawmakers, taking the nation a step closer to raising $1 billion via the world’s first sovereign blockchain bond. It strikes me as extremely risky considering Bitcoin’s inherent volatility.

That crypto tokens are good assets seems to be under the microscope even as their prices dissolve under the pressure of the FTX scandal and the over 1 million creditors involved. The web of deceit is worthy of crypto bros going mainstream in the most bizarre way yet.

Exodus from Coinbase?

What do the whales know that we do not? On Nov.24, 50,000 BTC were withdrawn from Coinbase. The amount equated to over $800 million at the time, which marked the second-largest BTC withdrawal from Coinbase in 2022. The next day, on Nov. 25, another 50,000 BTC withdrawal took place, which equates to over $825 million.

The chart below represents Coinbase’s BTC deposits and withdrawals since the exchange was launched in 2014.

For Coinbase this is a real crisis.

It seems to represent a real shift in where retail investors and big whales are comfortable keeping their Bitcoin. I’ve been speaking more about a shift from centralized exchanges to DEXs in 2023 speeding up. Binance is also playing tycoon gains behind the scenes.

All of this drama is putting a new test of faith for the Bitcoin believers and cult of crypto. These assets are not correlated to anything tangible but a manipulated supply-and-demand tokenomics of the ponzi-scheme variety.

If there was anything revolutionary about the tech, we would have seen more utility after a decade. Rumors of how great blockchain and DeFi are may have been grossly exaggerated for profit. I’m seeing the same thing happen of course in A.I. and Quantum hype trends which I cover.

Coinbase is not the only one though, crypto contagion is most damaging on user trust. The data shows that Coinbase is not the only exchange experiencing large BTC withdrawals. The chart below demonstrates the BTC balance on all exchanges since January 2018, and a significant downfall can be seen since January 2022.

Crypto bulls will just argue this is natural for a crypto winter. As FOMO turns to real fear. Death, taxes and oh yes, crypto FUD.

Cathie Wood is still trying to prop up Coinbase, even though its Earnings showed just how much its losing per quarter in the crypto winter. Depending on how long it lasts, the company could face financial pressures in 2023 or 2024.

As for the impact of FTX contagion on the sector, it’s likely only just begun.

Thanks for reading!