With the fall of algorithmic stablecoins, there are always new stablecoins to take their place. Now, a popular decentralized finance (DeFi) protocol is preparing to launch its own community-supported US dollar-pegged stablecoin.

Introducing: GHO

Aave Companies is proposing to the DAO the introduction of a native decentralized, collateral-backed stablecoin, GHO, pegged to USD.

In a new announcement, lending and borrowing platform Aave (AAVE) says it will build the new stablecoin, known as GHO, on leading smart contract platform Ethereum (ETH).

In May, terraUSD, a so-called “algorithmic” stablecoin broke its dollar peg, causing a run. Within the space of a week, investors were out $48 billion. But in crypto there are no losers, just new winners.

Such is the array of so many innovative solutions and new projects. If NFTs stumble, there’s always rock-solid DeFi solutions.

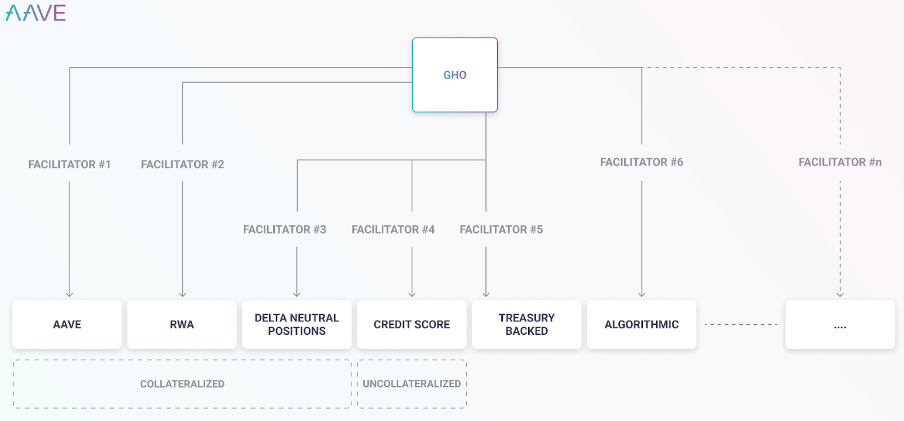

With community support, GHO can be launched on the Aave Protocol, allowing users to mint GHO against their supplied collaterals. GHO would be backed by a diversified set of crypto-assets chosen at the users’ discretion, while borrowers continue earning interest on their underlying collateral. As described below, all decisions relating to GHO will be in the hands of Aave Governance.

If approved, the introduction of GHO would make stablecoin borrowing on the Aave Protocol more competitive, provide more optionality for stablecoin users and generate additional revenue for the Aave DAO by sending 100% of interest payments on GHO borrows to the DAO.

Lune how could you do that to us? But do not worry, now there’s GHO stablecoin and memecoin Shiba Inu developers proposing the SHI stablecoin. A treasury full of temporary stablecoins. Temporary being my new name for altcoins. Temp coins. Crickets? That’s okay.

The Splendid DOA governed DeFi backed Stablecoins

The announcement was made by Aave Companies — the centralized entity supporting the Aave protocol — on its Twitter page on Thursday, stating:

“We have created an ARC for a new decentralized, collateral-backed stablecoin, native to the Aave ecosystem, known as GHO.”

Twitter loves its crypto, num num.

According to the governance proposal shared on Thursday, GHO would be an Ethereum-based and decentralized stablecoin pegged to the U.S. dollar that could be collateralized with multiple assets of the user’s choice. That sure doesn’t sound risky?

While Terra’s collapse may have cast a shadow over stablecoins, one big DeFi player doesn’t appear to be deterred. Aave is an impressive company.

According to FinTech expert Lex Sokolin: As users are essentially borrowing the stablecoin against their holdings, the position will need to be overcollateralized as per any normal Aave loan.

Mysterious and wonderful, I am sure. Aave (AAVE) is the native cryptocurrency of the Aave platform: a decentralized finance (DeFi) platform where users can borrow a range of cryptocurrencies, as well as lend assets in exchange for interest payments, all without needing a middleman.

The AAVE token is over $90 now. https://coinmarketcap.com/currencies/aave/

Crypto News outlets are calling it a “game-changer”. GHO, is being hyped as revolutionary.

This sure does sound like a lot of borrowing. The GHO stablecoin would be minted by borrowing against assets locked as collateral on Aave.

The proposal now goes to the Aave DAO for a vote. Thank God they have a DAO for this.

According to DeFi experts, Stablecoins are growing fast.

Introduction

In the last couple of years, stablecoins have reached a central position in the space, now standing at an approximate $150B market capitalization. What do Stablecoins do? Stablecoins provide a fast, efficient, borderless and stable way to transfer value on the blockchain. Decentralized stablecoins add transparency and censorship resistance to this list of benefits – an integral part of web3.

When crypto’s community is all about the bullish aspects of blockchain and not any bearish criticism, I wonder what “censorship resistance” even means in 2022. Are wall gardens and crypto communities that are all about positive sentiment even objective? I’d be happy to find a hype-resistant media outlet as well in Web3?

According to the leading DeFi firms back by traditional VC funding, the usage of stablecoins will only continue to grow as crypto assets become further integrated with a user base that is less crypto-native. Decentralized stablecoins provide censorship-resistant fiat-denominated currency on the blockchain.

Buckets of DeFi

For each Facilitator, Governance will also have to approve something that they call a bucket. A bucket represents the upward limit of GHO a specific facilitator can generate.

I’m just grateful Aave seems to have this figured out:

I also want access to the buckets of crypto.

What a fascinating business model though?

Borrowers would still earn yield on their deposited assets, while also racking up interest on their borrowed GHO, according to Aave Companies’ proposal. The interest payments would go directly to the DAO treasury, and could be considered revenue, according to them.

‘GHO’-ing to the moon

I’m not a Jedi of crypto-economics, but I wish I was. Many young folk have gotten rich on schemes like this one, and we no longer hear much about those who have lost a lot.

I too want to Gho to the moon. Especially with all this security I get from trusting the DAO. The crypto project’s decentralized autonomous organization (DAO) will be responsible for approving and then governing the token. Certainly they have incentives aligned with truth, regulation and stability of the proposed stablecoin.

“The power of DeFi is that GHO allows more liquidity for decentralized stablecoin[s] in the market, more fees for Aave, more volume and fees for Curve, more stability for other stablecoins, more attractiveness of DeFi in general compared to CeFi,” wrote Mark Zeller, integrations lead at Aave.

The super-powers of DeFi are definately intriguing.

Ghostly Stability

Aave is primarily a collateralized DeFi lending/borrowing platform that provides investors who provide cryptocurrencies to be loaned out a high interest rate.

Borrowers put up collateral worth up to 125% to 150%, which is automatically liquidated if the volatile crypto markets cause the collateral’s value to drop too low. Aave is one of the largest, with more than $6.5 billion locked in by lenders.

If significant volatility would hit Bitcoin, I believe Tether and Aave could be at existential risk. If that were to occur we’d enter a crypto winter black swan event. Such a vortex could last longer then the last crypto winter which lasted three years.

DeFi truly is another kind of monetary beast.

Instead of burning our token to make it more valuable guys, let’s just discount our community. A discounted rate on GHO borrowing would be offered to users staking AAVE tokens, potentially driving more value to the digital asset.

Aave, the one true Necromancy community of Crypto! Let’s profit even in death and downturns.

Do you consider yourself wishing death upon the banking community? Then join the movement. Became an undertaker.

Thanks for reading!